Debt Prevention & Resolution

If you're grappling with the burden of accumulated debt, know that you are not alone.

"A recent Clever Real Estate survey found that 3 in 5 Americans (61%) are in credit card debt, owing an average of $5,875. In addition, 23% say they go deeper into credit card debt every month and 14% say they've missed a payment in 2023."1

At Centura, we firmly believe enhancing financial literacy can help individuals a) steer clear of debt pitfalls or b) navigate effective paths toward debt resolution by increasing overall financial understanding.

The Dangers of High-Interest Rate Debt

High-interest rate debt can be a formidable adversary on your financial journey. Whether it's credit card debt, personal loans, or other forms of borrowing with steep interest rates, these financial obligations can pose serious threats to your financial health. Here's why high-interest rate debt is a cause for concern:

-

Costly Interest Charges: High-interest rates lead to substantial interest charges, making it more difficult to pay down the principal amount and resulting in a longer repayment period.

-

Impact on Credit Score: Accumulating high-interest debt can negatively impact your credit score, limiting your ability to secure favorable interest rates on future loans and affecting your financial reputation.

-

Financial Stress: The burden of high-interest debt can cause stress and anxiety, affecting your overall well-being and hindering your ability to pursue other financial goals.

The Importance of an Adequate Emergency Fund

One effective strategy to prevent the accumulation of high-interest debt is to establish and maintain an adequate emergency fund. Here's why having an emergency fund is crucial:

-

Financial Safety Net: An emergency fund acts as a safety net, providing a financial cushion to cover unexpected expenses such as medical bills, car repairs, or home maintenance.

-

Prevents Reliance on Credit: With a well-funded emergency fund, you're less likely to resort to high-interest credit options to cover unforeseen expenses. This proactive approach helps you avoid falling into the cycle of debt.

-

Peace of Mind: Knowing you have a financial buffer in place can reduce stress and provide peace of mind, allowing you to navigate through challenging situations without resorting to high-interest debt.

Debt Reduction Strategies

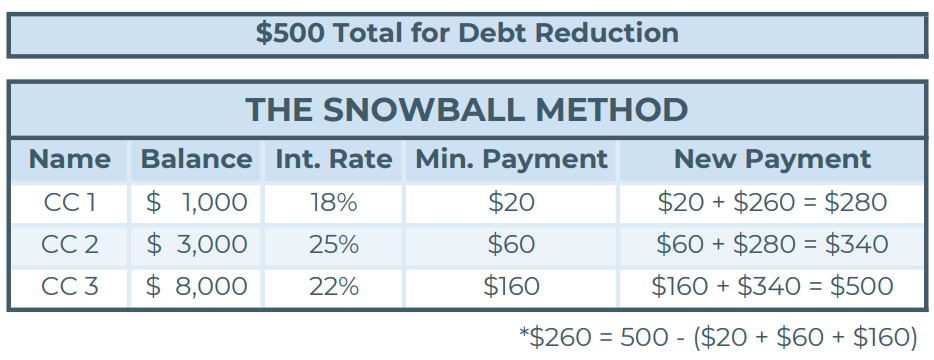

The Snowball Method

The Snowball Method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts. Here's how it works:

- List Debts in Ascending Order: Arrange your debts from smallest to largest.

- Minimum Payments: Continue making minimum payments on all debts.

- Extra Payments: Allocate any extra funds to pay off the smallest debt first.

- Snowball Effect: Once the smallest debt is paid off, roll the amount you were paying towards it into the next smallest debt, creating a snowball effect.

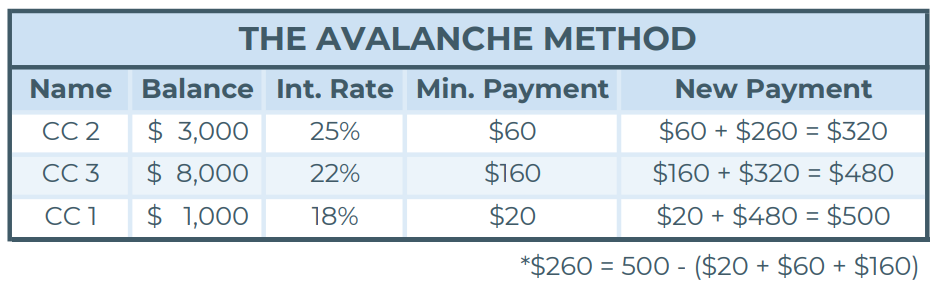

The Avalanche Method

The Avalanche Method prioritizes debts with the highest interest rates, minimizing overall interest payments. Follow these steps:

- List Debts by Interest Rate: Arrange debts from highest to lowest interest rates.

- Minimum Payments: Make minimum payments on all debts.

- Extra Payments: Allocate extra funds to pay off the debt with the highest interest rate.

- Cascade Effect: Once the highest interest debt is paid off, redirect the payment amount to the debt with the next highest interest rate.

Both methods require discipline and consistency, so choose the one that best aligns with your financial goals and preferences.

1Yahoo Finance: Jaw-Dropping Stats About the State of Debt in America

Need help with unmanageable debt? Contact us to set up a complimentary consultation!