Compound Interest

"Compound interest is the eighth wonder of the world.

He who understands it, earns it... He who doesn't...pays it."

- Albert Einstein1

As Einstein hinted, understanding and leveraging this financial powerhouse can be a game-changer in your wealth-building journey.

Many individuals overlook the potential of compound interest and the significant role time plays in growing their financial assets. Consequently, they find themselves working harder later in life to compensate for the time lost.

We aim to bridge that knowledge gap, illustrating how starting early and allowing your money to work over time can significantly reduce the effort needed to achieve your financial objectives.

What is Compound Interest?

Compound interest is the magic that happens when you not only earn interest on your initial investment but also on the interest that accumulates over time.

In simpler terms, it's interest earning interest.

How Does it Work?

Let's break it down. Imagine you invest $1,000 at an annual interest rate of 5%. In the first year, you earn $50 in interest, bringing your total to $1,050.

Now, in the second year, you earn 5% not just on your initial $1,000 but on the $1,050, resulting in $52.50 in interest.

Over time, this compounding effect accelerates, increasing the rate at which your money grows.

Why Should I Use It?

-

Exponential Growth: Unlike simple interest, where interest is calculated only on the initial principal, compound interest allows you to earn interest on both the principal and the previously earned interest. Over time, this compounding effect leads to exponential growth, as the interest earned in each period contributes to the overall amount subject to future interest calculations.

-

Inflation Protection: Compound interest helps your savings or investments outpace inflation. As your money grows over time, it retains its purchasing power and may even exceed the rate of inflation, ensuring that your wealth maintains or increases in real terms.

-

Passive Wealth Building: Compound interest allows you to passively build wealth without active effort. Once your initial investment is made, the compounding process continues without requiring additional contributions. This makes it a powerful tool for building wealth while minimizing the need for constant attention or intervention.

-

Risk Mitigation: Over a longer investment horizon, the impact of market fluctuations and short-term volatility tends to be less pronounced. Compound interest can help smooth out the effects of market ups and downs, providing a buffer against short-term market fluctuations.

The Power of Time & Compound Interest

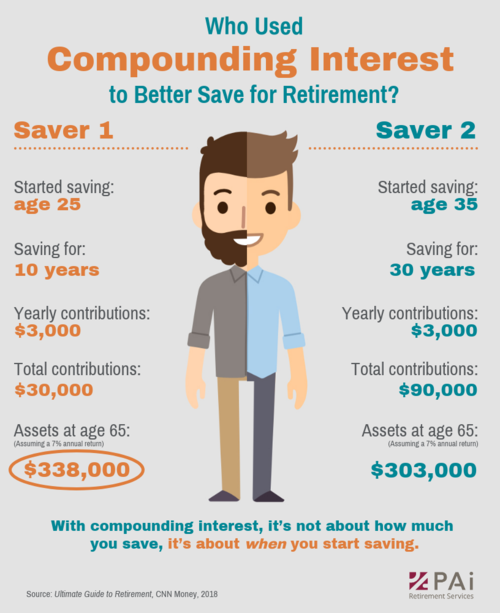

Time is a key ingredient in the wealth-building recipe, which becomes evident when we compare Saver 1 and Saver 2.

Saver 1 started saving $3,000 a year at age 25, and did so for 10 years then stopped contributing. That means he invested a total of $30,000.

At age 65, Saver 1 will have $338,000, assuming a 7% annual rate of return.

Saver 2 saved the same amount, $3,000 a year, but he began saving 10 years later, at age 35. He saved for 30 years, investing a total of $90,000.

At age 65, Saver 2 will have $303,000 with the same 7% annual return.

Despite Saver 2 having saved 3x as much and for 3x as long, Saver 1 will still have a higher account balance at age 65 because his initial investment began compounding earlier.

The longer the money is allowed to compound, the more time it has to capitalize on the compounding phenomenon, the more substantial the growth.

As you can see, it's not about how much you save... it's about when you start saving.

The earlier you start, the better off you'll be and the less you'll have to contribute to meet your goals!

Using Compound Interest to Your Advantage

Start Early, Benefit More

The key takeaway is to start early. The longer your money has to compound, the more significant the returns. Even small, consistent contributions can yield substantial results over time.

Diversify Your Investments

Explore diverse investment options to maximize the benefits of compound interest. From stocks to bonds and retirement accounts, a well-balanced portfolio can amplify your wealth-building potential.

Regularly Contribute and Reinvest

Consistent contributions and reinvesting your earnings can amplify the compounding effect. This approach turbocharges the growth of your investments, making your money work harder for you.

1Compound Interest: 'The Eighth Wonder of the World'

Ready to start taking advantage of compound interest to build your wealth? Request a free consultation to learn how our Asset Management service can help you!