Financial Planning Fees

We take an individualized approach to address your unique situation and goals in our financial planning service. Therefore, fees are largely dependent on your financial situation and service needs.

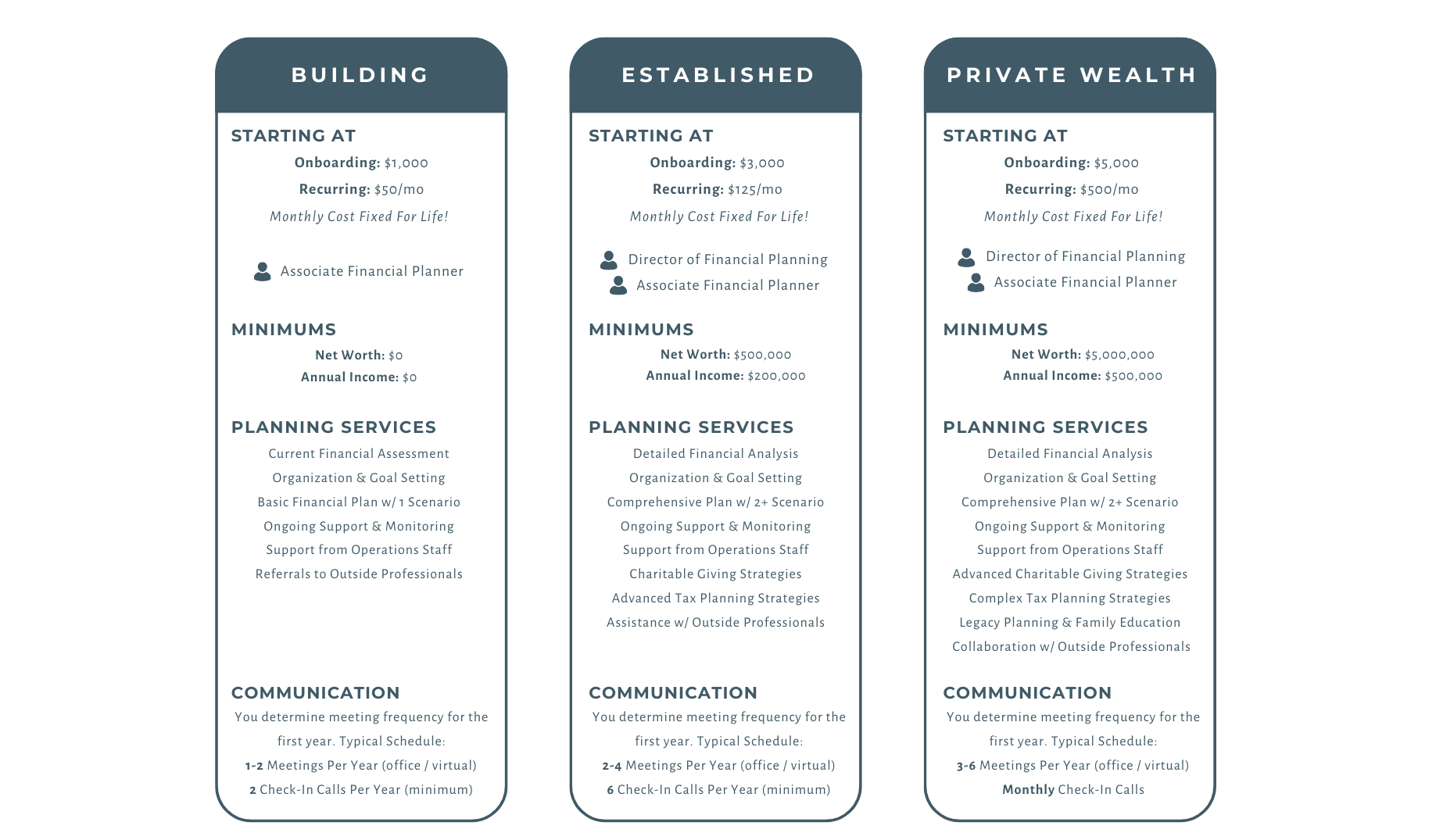

Although they vary greatly between clients, an outline of our general fee structure is provided below.

Onboarding Fee:

Financial planning involves a substantial upfront commitment from the planner, as there is an increased demand for time and attention during the initial stages. Additionally, more meetings will be necessary in the evaluation and data gathering processes.

Instead of billing by the hour to compensate, we charge a one-time onboarding fee to ensure we're able to dedicate the time needed to develop a thorough understanding of your financial situation and goals. The onboarding fee is dependent on the complexity of your financial situation and needs.

Recurring Monthly Fee:

Following the onboarding process, our financial planning services typically include a recurring monthly fee, unless you prefer to pay upfront.

This fee is based on the complexity of your financial situation, meaning what you pay will reflect the depth of our services.

Packages

*Please note that all fees outlined on this page are subject to change based on individual client needs and preferences. Fees vary based on the complexity of your financial situation and the level of service provided. Please verify your current or proposed fee structure with your advisor!