Understanding & Improving Credit

Credit scores emerge as crucial players in personal finance, influencing everything from loan approvals to interest rates. Understanding credit, and how to improve or maintain it, is essential for financial well-being.

At its core, a credit score is a numerical representation of an individual's creditworthiness, reflecting their history of managing credit and debt. Ranging from 300 to 850, a higher score generally indicates a more favorable credit profile.

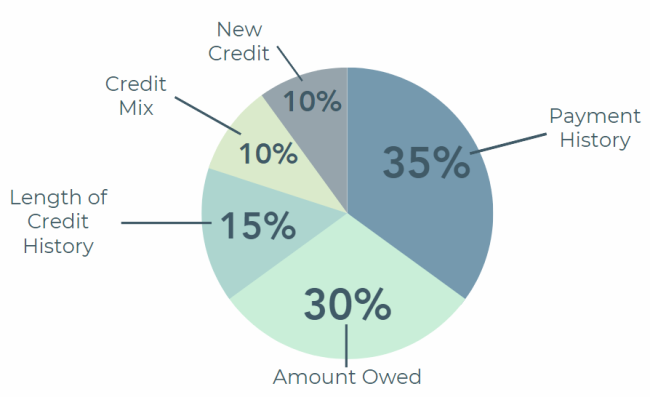

Factors Impacting Credit Scores

-

Payment History: Timely payments are the bedrock of a healthy credit score.

-

Credit Utilization: The ratio of credit used to credit available impacts scores; maintaining a lower ratio is advantageous.

-

Length of Credit History: A longer credit history often leads to a more favorable score.

-

Types of Credit in Use: A diverse credit portfolio can positively impact scores.

-

New Credit: Opening multiple accounts in a short period may be perceived negatively.

Methods to Maintain or Improve Credit Scores

-

Timely Payments: Consistently pay bills on time to fortify your credit history.

-

Manage Credit Utilization: Keep credit card balances low to enhance your creditworthiness. A good rule of thumb is to keep usage below 30% of your available credit.

-

Check Your Credit Report: Regularly review your credit report for errors and discrepancies. By law, you are entitled to a free credit report from each of the 3 major credit bureaus (Equifax, Experian, & TransUnion) each year! Visit www.AnnualCreditReport.com to request.

-

Diversify Your Credit Portfolio: A mix of credit types, such as credit cards and installment loans, can positively impact your score.

-

Avoid Opening Too Many Accounts: A high number of recent credit inquiries may be viewed unfavorably.

Common Misconceptions

-

Closing a Credit Card Improves Scores: Closing an account can negatively impact your credit utilization ratio, potentially lowering your score. Keep long standing accounts open, even if they have a zero balance!

-

Checking Your Credit Hurts Your Score: Checking your own credit report is a soft inquiry and doesn't impact your score.

-

Income Influences Your Score: Income is not a direct factor in determining credit scores; it's about managing credit responsibly.

-

No Credit History is Good: Having no credit history might result in a lower score, as there's insufficient data to evaluate creditworthiness.

Interested in Financial Planning? Reach out to set up an initial discovery meeting!